All Categories

Featured

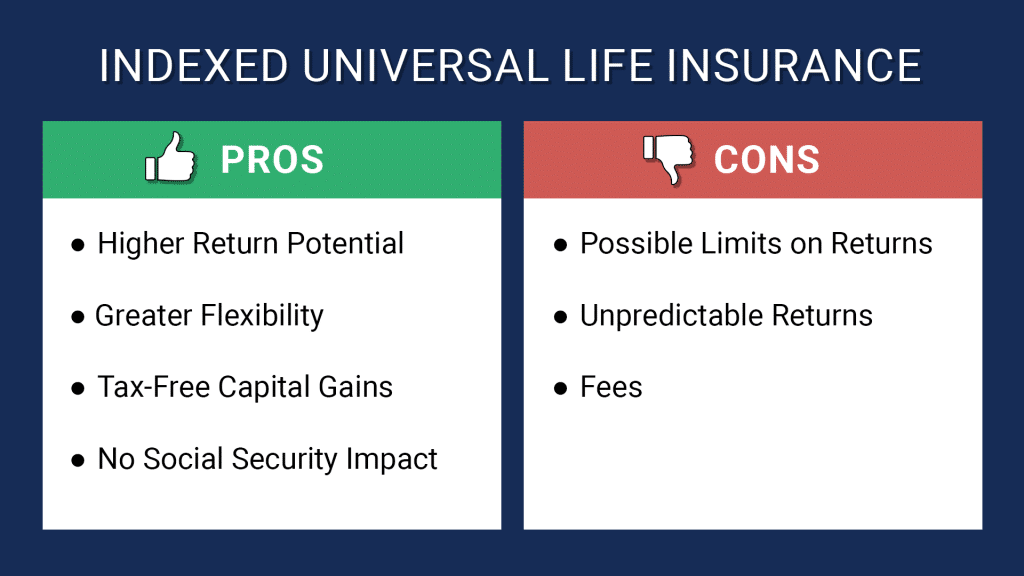

IUL agreements secure against losses while offering some equity risk premium. Individual retirement accounts and 401(k)s do not offer the same downside defense, though there is no cap on returns. IULs have a tendency to have have made complex terms and greater charges. High-net-worth individuals looking to decrease their tax obligation burden for retired life may benefit from investing in an IUL.Some capitalists are better off buying term insurance while maximizing their retired life strategy contributions, as opposed to acquiring IULs.

If the underlying supply market index rises in a provided year, proprietors will certainly see their account rise by a proportional quantity. Life insurance policy business use a formula for establishing just how much to credit your cash balance. While that formula is connected to the performance of an index, the quantity of the credit scores is usually mosting likely to be much less.

With an indexed universal life plan, there is a cap on the amount of gains, which can restrict your account's growth. If an index like the S&P 500 boosts 12%, your gain can be a portion of that amount.

Indexed Universal Life (Iul) Vs. 401(k): Key Differences For Retirement Planning

Irreversible life insurance coverage depends on have long been a prominent tax shelter for such individuals. If you fall right into this group, consider talking with a fee-only economic advisor to go over whether getting permanent insurance policy fits your general method. For lots of financiers, though, it may be better to max out on payments to tax-advantaged pension, especially if there are contribution suits from a company.

Some policies have an ensured rate of return. One of the vital functions of indexed global life (IUL) is that it offers a tax-free distributions. It can be a helpful device for investors who desire options for a tax-free retirement. Generally, financial advisors would certainly suggest contribu6ting to a 401(k) before an individual retirement account particularly if your company is giving matching contributions.

Perfect for ages 35-55.: Offers adaptable coverage with moderate money value in years 15-30. Some things customers should take into consideration: In exchange for the fatality advantage, life insurance coverage products bill costs such as death and expense risk costs and surrender costs.

Retirement planning is crucial to preserving monetary security and retaining a particular requirement of living. of all Americans are stressed over "preserving a comfortable standard of life in retired life," according to a 2012 study by Americans for Secure Retired Life. Based on recent statistics, this majority of Americans are justified in their concern.

Department of Labor estimates that a person will certainly need to keep their present criterion of living when they begin retired life. In addition, one-third of U.S. homeowners, between the ages of 30 and 59, will certainly not be able to maintain their criterion of living after retirement, even if they delay their retirement up until age 70, according to a 2012 research study by the Fringe benefit Study Institute.

Iul Com

In the same year those aged 75 and older held an ordinary financial obligation of $27,409. Alarmingly, that number had even more than increased considering that 2007 when the ordinary financial debt was $13,665, according to the Staff member Benefit Research Institute (EBRI).

56 percent of American senior citizens still had impressive financial debts when they retired in 2012, according to a survey by CESI Debt Solutions. The Roth IRA and Policy are both tools that can be used to develop substantial retired life savings.

These economic devices are comparable because they benefit policyholders that desire to generate savings at a reduced tax rate than they may encounter in the future. Make each a lot more eye-catching for individuals with differing requirements. Determining which is better for you depends upon your personal scenario. The policy grows based on the interest, or returns, attributed to the account.

That makes Roth IRAs ideal cost savings lorries for young, lower-income workers who live in a lower tax obligation brace and who will certainly gain from decades of tax-free, compounded development. Given that there are no minimum needed contributions, a Roth IRA offers financiers control over their individual objectives and take the chance of tolerance. In addition, there are no minimum needed distributions at any kind of age throughout the life of the plan.

a 401k for employees and employers. To compare ULI and 401K strategies, take a moment to recognize the basics of both products: A 401(k) allows staff members make tax-deductible payments and take pleasure in tax-deferred growth. Some employers will certainly match component of the worker's payments (Indexed Universal Life (IUL) vs IRA: A Comparison of Investment Strategies). When workers retire, they typically pay tax obligations on withdrawals as common income.

Iul Lebanon

Like various other irreversible life policies, a ULI plan additionally assigns component of the costs to a money account. Insurers will certainly peg the price of return on this account to an economic index, like the S&P 500. The cash money account will certainly relocate up when its index climbs. Considering that these are fixed-index plans, unlike variable life, the plan will additionally have a guaranteed minimum, so the cash in the money account will not reduce if the index declines.

Plan proprietors will also tax-deferred gains within their cash money account. Indexed universal life insurance vs retirement accounts. Explore some highlights of the advantages that global life insurance can offer: Universal life insurance policies don't enforce limits on the dimension of plans, so they might supply a means for staff members to save more if they have currently maxed out the IRS limits for various other tax-advantaged monetary items.

The IUL is much better than a 401(k) or an IRA when it comes to conserving for retirement. With his virtually 50 years of experience as a financial planner and retired life planning professional, Doug Andrew can reveal you exactly why this is the instance.

Latest Posts

Fixed Indexed Universal Life Insurance Reviews

Iul Vs Roth Ira

Universal Life Insurance Cost